does nj offer 529 tax deduction

In New Mexico families can deduct 100 of their contributions to New Mexicos 529 plan on their state taxes. However not all states follow the federal tax treatment of K-12 tuition or student loan expenses.

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

New York Can deduct up to 5000 per year per person.

. This tool isnt intended to constitute nor does it constitute tax advice or an investment recommendation. A 529 plan is designed to help save for college. 529 data provided by SSC.

5000 single 10000 joint. The incentive for 529 plans is that after-tax money grows free of federal and state taxes and will not be taxed when the money is taken out for education. However Indiana Utah and Vermont offer a state income tax credit for 529 plan contributions and Minnesota offers a state income tax deduction or tax credit depending on the taxpayers adjusted gross income.

See How Easy It Is With TurboTax. Just as there are no federal tax deductions for 529 Plans North Carolina also does not offer in-state tax deductions for contributions to NC 529 Accounts. Section 529 - Qualified Tuition Plans.

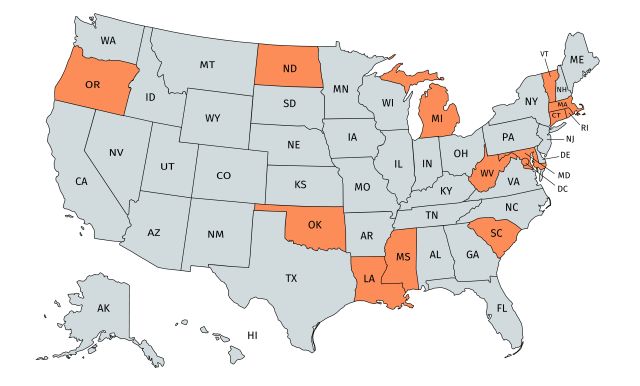

If you invest 1000 and earn 5 during a year youre not taxed on the 50 you earned. While most states have dollar limits on 529 deductions Colorado New Mexico South Carolina and West Virginia allow you to deduct the full amount of contributions to their respective 529 plans. Most states that have an income tax allow either a deduction from income or a state tax credit for 529 plan contributions when reporting income for state tax purposes.

NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. Therefore the best states from a tax perspective will be those that offer the biggest deductions. New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan.

Ohio Contributions up to 4000 can be deducted per beneficiary per year. 5000 per parent 10000 joint. 2 NJBEST Scholarship - 500-1500 towards first semester of higher education at an accredited New Jersey school we explain details here.

Starting in 2022 New Jersey will offer a state tax deduction of up to 10000 per taxpayer per year for contributions to a New Jersey 529 plan. As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take advantage of up to a 1500 maximum. Note that there is no federal income tax deduction on 529 plan contributions.

Best 529 Plans in New Jersey. To get started you can deposit 25. Thats a deduction of up.

Some states do have income taxes but no 529 plan tax deduction. But it does offer these two key benefits. New Mexico All contributions to in-state 529 plans are deductible.

Some state 529 plans allow contributions to the plan to be deductible for in-state residents. 1 Favorable treatment when you apply for financial aid from the state of New Jersey. Part-year residents can only deduct those.

Only offered to account owners and their spouses. New Jersey law provides several gross income tax deductions that can be taken on the New Jersey Income Tax return. Depending on where you live or where you started your 529 plan you could be eligible for one of these benefits.

Full-year residents can only deduct amounts paid during the tax year. Unfortunately New Jersey does not offer any tax benefits for socking away funds in a 529 account for your child. Contributions of up to 15000 per beneficiary can be funded annually and married couples can contribute up to 30000 annually.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Unlike many states the IRS does not provide a current tax deduction for contributions made to the plan. If you use the money for qualified.

No New Jersey does not offer tax deductions for 529 plans. New Jersey does not provide any tax benefits for 529 contributions. New Jersey offers two 529 college savings plans said.

Contributions to such plans are not deductible but the money grows tax-free while it remains in the plan. You must have a gross income of 200000 per year or less. Thankfully NJ residents can open an account in any other state that lets them.

There is no time in which the funds within a New Jersey 529 plan need to be withdrawn. Say I have qualified education expenses of 10000 and I take a withdrawal of 10000 from a 529 Plan and 1000 are earnings. New Jerseys plans do not give that advantage.

New Jersey does not offer any state tax benefits for opening a NJ 529 plan. What happens to a New Jersey 529 Plan if not used. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan.

For my federal return I claim the full 2500 American Opportunity Tax Credit AOTC based on 4000 of the Qualified Education Expenses. The most common benefit offered is a state income tax deduction for 529 plan contributions. New Jersey has two 529 savings programs both.

The growth of your account isnt taxed either. Get Your Max Refund Today. Direct this New Jersey 529 plan can be purchased directly from the state.

According to the guidelines my qualified expenses are reduced by 4000 to. File Your Taxes Absolutely Free From Any Device. Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for education.

North Dakota Up to 5000 can be deducted per person annually. You must be a New Jersey resident to contribute to a. You should consult your own tax advisor or financial advisor for more information on the tax implications and benefits or disadvantages of investing in a 529 plan based on your own particular circumstances.

College savings plans fall under Internal Revenue Code Section 529 Qualified Tuition Programs. New Jersey does not allow federal deductions such as mortgage interest employee business expenses and IRA and Keogh Plan contributions.

New Jersey 529 Plan And College Savings Options Njbest

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

529 Plans Which States Reward College Savers Adviser Investments

Nj 529 Plan Tax Deduction And Other Benefits For New Jersey Students

N J S College Savings Plan Is One Of The Worst In The Nation It S About To Get Way Better State Says Nj Com

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Can You Have Multiple 529 Plans Savingforcollege Com

New Jersey 529 Plans Learn The Basics Get 30 Free For College

529 Tax Deductions By State 2022 Rules On Tax Benefits

Pin On 529 College Savings Plan Board 529 Plans

Hawaii 529 Plans Learn The Basics Get 30 Free For College Savings

Can I Use A 529 Plan For K 12 Expenses Edchoice

New Year Brings Tax Breaks For Student Borrowers New Jersey Monitor

How Much Should You Have In A 529 Plan By Age

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Clueless About 529 Plans Here S A Guide Nj Com