inherited annuity tax rate

Taxes on an inherited IRA are due when the money is withdrawn from the account and taxed at your ordinary income tax rates. After that age taking your withdrawal as a.

Inheritance Tax Here S Who Pays And In Which States Bankrate

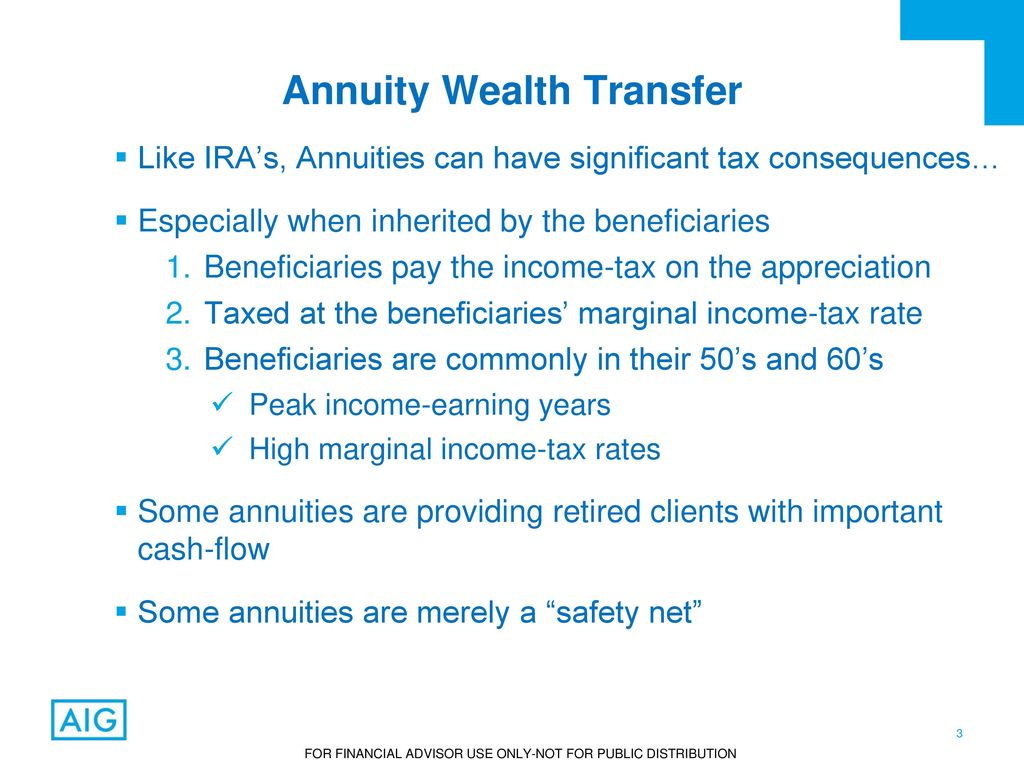

In turn taxation of annuity distributions.

. So the tax rate on an inherited annuity is your regular income tax rate. In general if you withdraw money from your annuity before you turn 59 ½ you may owe a 10 penalty on the taxable portion of the withdrawal. The earnings are taxable over the life of the payments.

Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. Only a spouse can inherit an annuity and benefit from the options the late. If you expect to inherit an annuity its important to consider beforehand how.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. What is the tax rate on an inherited annuity. Any distributions paid to the annuitant from a qualified annuity are treated as taxable income in the year theyre received.

An individual who inherits a non-qualified annuity can take a lump-sum cash payment or a stream of payments. The tax rate on an inherited annuity is determined by the tax rate of the person who inherits it. Taxes are due once money is.

Taxes are typically due only on a traditional IRA. So the tax rate on an inherited annuity is your regular income tax. The rates for Pennsylvania inheritance tax are as follows.

Penalties for cashing out an inherited annuity depend on the type of annuity and the beneficiarys age. When a person inherits an annuity the gains stay with the policy. Different tax consequences exist for spouse versus non-spouse beneficiaries.

45 percent on transfers to direct. When inheriting an annuity from a parent you will have to pay taxes on payments as ordinary income. Inherited annuities are considered to be taxable income for the beneficiary.

Tax Rate on an Inherited Annuity. Either way you will pay regular taxes only on the interest. Tax Consequences of Inherited Annuities.

Only a spouse can inherit an annuity and benefit from the options the late. If the annuity was an IRA annuity the SECURE Act that went into effect on January 1 2020 stipulates that if you inherit an IRA youll now generally have 10 years after the account holders. So the tax rate on an inherited annuity is your regular income tax rate.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Depending on the type of annuity the tax will have to be paid on the lump sum received or on the regular fixed. Taxes are due once money is.

Whether or not an inherited annuity is subject to inheritance or estate tax the beneficiary is liable for income tax. Inherited annuities are considered to be taxable income for the beneficiary. How taxes are paid on an.

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. If you keep the annuity you will usually have to start taking withdrawals from it. Inherited annuities are considered to be taxable income for the beneficiary.

Just like any other qualified account such as a 401 k or an individual. Surviving spouses can change the original contract. When inheriting an annuity from a parent you will have to pay taxes on payments as ordinary income.

Do I Pay Taxes On All Of An Inherited Annuity Or Just The Gain

Trust Vs Restricted Payout As Annuity Beneficiary

How Are Inherited Annuities Taxed

Annuity Tax Consequences Taxes And Selling Annuity Settlements

![]()

Inherited Annuity Tax Guide For Beneficiaries

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Trust Vs Restricted Payout As Annuity Beneficiary

3 Basic Options Inherited Qualified Annuity Mintco Financial

Annuity Exclusion Ratio What It Is And How It Works

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

How To Avoid Paying Taxes On An Inherited Annuity

Understanding Annuities And Taxes Mistakes People Make

![]()

Inherited Annuity Tax Guide For Beneficiaries

How To Avoid Paying Taxes On An Inherited Annuity

Wealth Transfer Strategies Annuities Stocks And Other Assets Joe Ross Chfc Clu Crc Vice President Sales Productivity Business Development Aig Ppt Download

Annuity Beneficiary Learn Payout Structure Death Benefits More

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due